chanel vat refund in paris | Chanel goyard vat refund chanel vat refund in paris In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your . 1br 427ft2. $345. • • • • • • • •. Apartment for rent 1x1 $1030 sqft 536 Come in and Tour. 54 mins ago

0 · where to get a vat refund

1 · vat refund Paris 2024

2 · how much is the vat refund

3 · gare de lyon vat refund

4 · france vat refund

5 · Paris train station vat refund

6 · Paris france vat refund schedule

7 · Chanel goyard vat refund

Welcome to the historic and iconic Las Vegas Country Club, host of 19 PGA Tour and LPGA Tour events plus the social hub of Las Vegas since 1967. Welcome to The Las Vegas Country Club! We hope that the below information is helpful as you enjoy our facilities as an invitied guest.

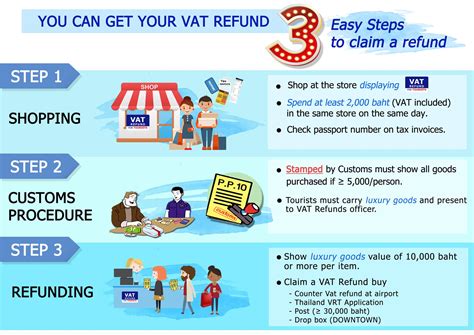

When you arrive at the Eurostar train station (if you are traveling to the UK), you can claim the VAT tax refund on the second floor after you go through security. Look for the sign. It is a self-automated machine. If you cannot find the machine, then I highly recommend you ask. Make sure you do this before you leave the . See moreParis is one of the most popular places in the world to go shopping with some of the most iconic brands. Remember that if you're a tourist visiting Paris, or any EU country spend over €100.01 you're entitled to the VAT Tax refund. Happy to answer any questions in the . See more

For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a . If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your .

Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be . Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de . PABLO stands as France’s electronic VAT refund processing system, offering a swift validation of your tax refund forms. Located within the Calais Terminal, it’s the most . Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax . In Paris, you can get the same bag for around 3.5% cheaper, plus the 12% VAT refund if you purchase with a credit card. Chanel Saint-Honoré. Photo by eyepreferparis on .

The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to Paris and go shopping during the off expect, expect to receive your refund quickly. For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you. If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund.

In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your VAT refund. To claim your VAT refund at Chanel in Paris, follow these steps: Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it!

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. PABLO stands as France’s electronic VAT refund processing system, offering a swift validation of your tax refund forms. Located within the Calais Terminal, it’s the most straightforward route to getting your refund processed. Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at .

where to get a vat refund

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc. In Paris, you can get the same bag for around 3.5% cheaper, plus the 12% VAT refund if you purchase with a credit card. Chanel Saint-Honoré. Photo by eyepreferparis on Instagram

gucci hair scarf

The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to Paris and go shopping during the off expect, expect to receive your refund quickly. For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your VAT refund. To claim your VAT refund at Chanel in Paris, follow these steps: Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it! Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping.

PABLO stands as France’s electronic VAT refund processing system, offering a swift validation of your tax refund forms. Located within the Calais Terminal, it’s the most straightforward route to getting your refund processed. Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at .By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.

vat refund Paris 2024

how much is the vat refund

The most detailed interactive Boulevard Pool At the Cosmopolitan of Las Vegas seating chart available, with all venue configurations. Includes row and seat numbers, real seat views, best and worst seats, event schedules, community feedback and more.

chanel vat refund in paris|Chanel goyard vat refund